The Rise of Automated Trading in Crypto: A Deep Dive into Sniper Bots,…

페이지 정보

본문

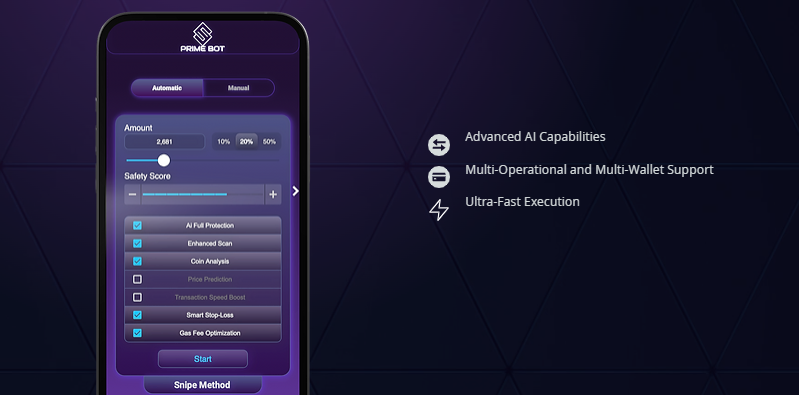

Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets. Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies.

For instance, if a bot sees a large buy order for a token, it can buy the token first, sell it at a higher price, and pocket the difference. Types of MEV Strategies

Front-Running: This occurs when a bot detects a large transaction and places its order first to profit from the resulting price movement.

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token sniper bot’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g., the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token sniper bot’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g., the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

The Sandwich Bot is an advanced trading bot that capitalizes on the concept of "sandwiching" transactions between two other trades. This is done by placing a buy order before a large transaction and a sell order immediately after it, sniper bot crypto bot solana profiting from the price increase caused by the large trade.

Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand. Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability.

What is a DeFi sniper bot crypto Bot?

A DeFi sniper bot crypto bot is a type of trading bot specifically designed to execute trades the moment new tokens are listed on decentralized exchanges (DEXs) or when there’s a sudden price movement. These bots are programmed to "snipe" tokens by placing buy orders immediately after a token’s launch, often before the average trader can manually complete a transaction.

What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot commands or integrations with Telegram groups dedicated to cryptocurrency trading. These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or PancakeSwap, allowing traders to get in on the action faster than they could manually.

These bots are specifically designed to react quicker than human traders, executing trades based on preset strategies. A newer addition to this family of bots is the BSC Sniping Bot, which operates on the Binance Smart Chain (BSC), an increasingly popular blockchain for trading. In the fast-paced world of cryptocurrency, trading bots have become indispensable tools for both casual traders and institutional investors alike. Among the most popular trading bots are sniper bot crypto Bots, Front-Run Bots, and Sandwich Bots—each offering distinct advantages in decentralized finance (DeFi).

Executing the Trade: Once the opportunity is detected, bsc front run bot the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

The cryptocurrency market has seen incredible growth over the past decade, with decentralized finance (DeFi) platforms becoming increasingly popular. While this growth has created opportunities for investors and traders, it has also led to the rise of automated trading strategies like front-running bots, which take advantage of inefficiencies and high-speed execution to profit from other traders.

One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities. As the cryptocurrency market grows increasingly competitive and fast-paced, traders are constantly seeking tools to gain an edge in executing timely and profitable trades. A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or significant market events.

While sniping bots can be a powerful tool, it's important to use them ethically and ethereum liquidity bot responsibly. Avoid engaging in activities that could harm the DeFi ecosystem, such as manipulating market prices or exploiting vulnerabilities in smart contracts.

Back-Running

In back-running, sniping bots a bot capitalizes on the aftermath of a significant market move. If a large trade has already occurred and telegram sniping bot significantly shifted the price of a token, a back-running bot might place a trade after the price movement in anticipation of the market returning to equilibrium or continuing to trend.

Gas Optimization: To ensure their transaction is included in the block before others, MEV bots often bid higher gas fees. This incentivizes miners to prioritize their transactions, ensuring they can front-run or sandwich other trades.

For instance, if a bot sees a large buy order for a token, it can buy the token first, sell it at a higher price, and pocket the difference. Types of MEV Strategies

Front-Running: This occurs when a bot detects a large transaction and places its order first to profit from the resulting price movement.

The Sandwich Bot is an advanced trading bot that capitalizes on the concept of "sandwiching" transactions between two other trades. This is done by placing a buy order before a large transaction and a sell order immediately after it, sniper bot crypto bot solana profiting from the price increase caused by the large trade.

Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand. Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability.

What is a DeFi sniper bot crypto Bot?

A DeFi sniper bot crypto bot is a type of trading bot specifically designed to execute trades the moment new tokens are listed on decentralized exchanges (DEXs) or when there’s a sudden price movement. These bots are programmed to "snipe" tokens by placing buy orders immediately after a token’s launch, often before the average trader can manually complete a transaction.

What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading bot that operates through the Telegram platform, typically through specific bot commands or integrations with Telegram groups dedicated to cryptocurrency trading. These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or PancakeSwap, allowing traders to get in on the action faster than they could manually.

These bots are specifically designed to react quicker than human traders, executing trades based on preset strategies. A newer addition to this family of bots is the BSC Sniping Bot, which operates on the Binance Smart Chain (BSC), an increasingly popular blockchain for trading. In the fast-paced world of cryptocurrency, trading bots have become indispensable tools for both casual traders and institutional investors alike. Among the most popular trading bots are sniper bot crypto Bots, Front-Run Bots, and Sandwich Bots—each offering distinct advantages in decentralized finance (DeFi).

Executing the Trade: Once the opportunity is detected, bsc front run bot the bot executes the trade, capturing the MEV by manipulating the transaction order. This process can be completed in milliseconds, making it highly efficient and profitable for the bot operator.

The cryptocurrency market has seen incredible growth over the past decade, with decentralized finance (DeFi) platforms becoming increasingly popular. While this growth has created opportunities for investors and traders, it has also led to the rise of automated trading strategies like front-running bots, which take advantage of inefficiencies and high-speed execution to profit from other traders.

One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities. As the cryptocurrency market grows increasingly competitive and fast-paced, traders are constantly seeking tools to gain an edge in executing timely and profitable trades. A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or significant market events.

While sniping bots can be a powerful tool, it's important to use them ethically and ethereum liquidity bot responsibly. Avoid engaging in activities that could harm the DeFi ecosystem, such as manipulating market prices or exploiting vulnerabilities in smart contracts.

Back-Running

In back-running, sniping bots a bot capitalizes on the aftermath of a significant market move. If a large trade has already occurred and telegram sniping bot significantly shifted the price of a token, a back-running bot might place a trade after the price movement in anticipation of the market returning to equilibrium or continuing to trend.

Gas Optimization: To ensure their transaction is included in the block before others, MEV bots often bid higher gas fees. This incentivizes miners to prioritize their transactions, ensuring they can front-run or sandwich other trades.

- 이전글The West is already embroiled in a new Cold War with China as the communist state continues a massive military build-up alongside its economic might, 24.10.16

- 다음글An Israeli missile worsens the adversity of five disabled siblings 24.10.16

댓글목록

등록된 댓글이 없습니다.